Historical price cycles and model-based indicators are signaling levels that traders and analysts are closely monitoring into early 2026.

Analysts caution that these indicators provide illustrative scenarios rather than guaranteed outcomes, and past patterns may not reliably predict future performance.

MTOPS and Gann Time Cycles: A Niche Timing Lens

Some analysts utilize Gann cycles and the Market Timing Oscillator/Projection System (MTOPS) to identify potential timing windows for BTC. While these methods are considered unconventional and are not widely adopted by institutional analysts, they offer a structured approach to observing historical time-price correlations.

-

Gann angles:

1×1 angles represent strong support or resistance along a 45° slope.

2×1 angles highlight moderate trends and potential price ceilings.

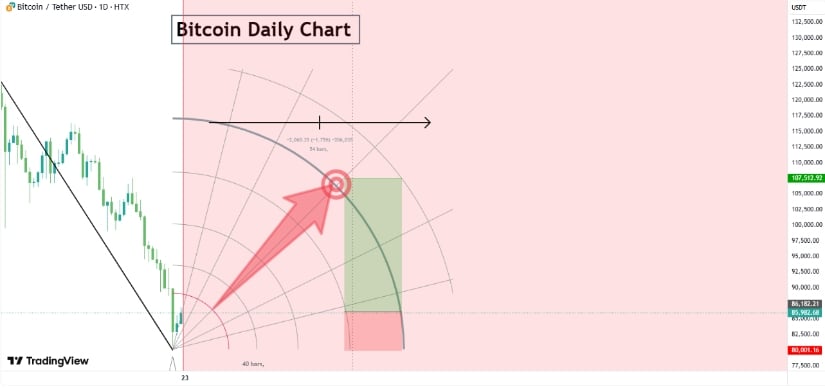

Using the MTOPS method and Gann analysis, Bitcoin is projected to face key resistance near $107,000 within the 23 November–1 January time window. Source: Blayno MTOPS on TradingView

Starting from 23 November 2025, MTOPS suggests a 40-day Gann timing window extending to 1 January 2026. According to analysts using this model, BTC could encounter resistance around $107,000 on the BTC/USD pair on a weekly chart, coinciding with a harmonic level in the Square of Nine framework.

“$107K is not just a round number—it’s a convergence of geometric resistance and historical timing cycles,” said Jordan Lee, a technical analyst specializing in Gann methods. “However, these models are indicative, not predictive.”

MVRV Bands Indicate Historical Support

On-chain analyst Ali Martinez, who focuses on MVRV trends, notes that Bitcoin’s MVRV Pricing Bands, reported by Glassnode, provide insight into potential support levels. Historically, Bitcoin has found bottoms near the green (1x realized price) and blue (0.8x realized price) bands, currently at $55,900 and $44,700, respectively, on the BTC/USD weekly chart.

Historically, Bitcoin ($BTC) has frequently found cycle lows below the green and blue pricing bands, which currently stand at $55,900 and $44,700, respectively. Source: Ali Martinez via X

Historical alignment with these bands includes:

-

December 2018: ~$3,200 (below blue band)—per Glassnode historical data

-

March 2020: ~$3,800 (below blue band)—per Glassnode data

-

November 2022: ~$15,500 (below green band) – Glassnode metrics

Rahman adds, “These levels have historically coincided with recoveries ranging from 3x to 10x within 12–18 months, but past performance does not guarantee future results.”

Technical Patterns: Conditional Observations

Some analysts observe an early structure that could evolve into a head and shoulders pattern on the BTC/USD weekly chart, with a potential right shoulder near $96–98K. If this scenario unfolds, a measured move could bring BTC down toward $60K, though this is entirely hypothetical.

Bitcoin may have peaked for this cycle, with a potential head-and-shoulders setup suggesting a drop toward $60K, while a bullish supercycle remains a lower-probability scenario. Source: crep on TradingView

Analysts emphasize that technical patterns are conditional and should be interpreted as analytical frameworks, not forecasts.

Whale Activity and Institutional Influence

Large holders, sometimes referred to as whales, can impact market sentiment. Observers note that high-profile BTC holders, including Michael Saylor, may influence short-term price swings, though any implications of strategic targeting remain speculative.

Strive Asset (ASST) holds 7,525 BTC (~$636M) and shows a bullish breakout pattern, reflecting high BTC correlation amid mixed market sentiment. Source: Akuchi Capital via X

Institutional positioning example:

-

Strive Asset Management (NASDAQ: ASST) reportedly holds 7,525 BTC (~$636M), with 72 BTC added via recent warrant exercises, according to SEC filings. Analysts note that institutional flows can amplify market movements, but the effects are dependent on broader market conditions.

Analysts highlight macroeconomic variables that could influence BTC trajectories:

-

Expansionary liquidity and potential rate cuts, according to macro strategist Dr. Priya Sen

-

ETF inflows are increasing institutional participation

-

Geopolitical and political developments shape broader market sentiment

These factors are conditional and not deterministic, meaning they may support bullish momentum but do not guarantee outcomes.

Looking Ahead: Clear Segmentation of Observed and Modeled Data

Bitcoin’s price analysis highlights several key levels to watch. Model-based targets indicate resistance near $107,000, based on Gann and MTOPS weekly charts; however, these are illustrative and not guaranteed. Historical support is identified between $55,900 and $44,700, using MVRV bands from Glassnode, which reflects empirical past bottoms. Analysts also note a hypothetical head and shoulders pattern with a right shoulder near $96–98K and a potential retracement toward $60K, which remains conditional.

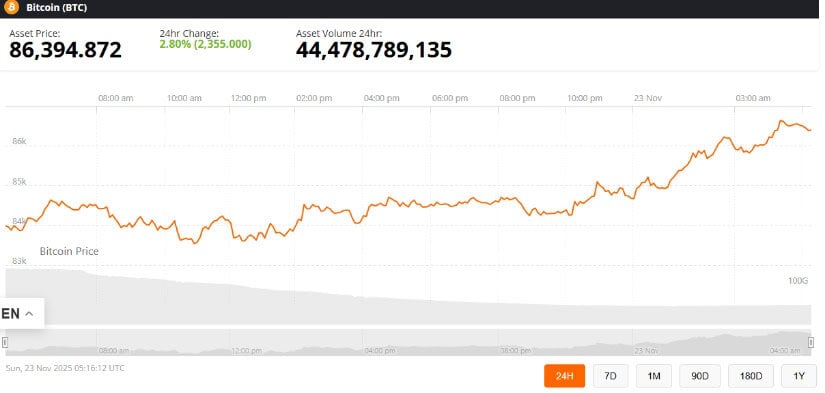

Bitcoin was trading at around 86,394.87, up 2.80% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Macro factors could influence BTC’s trajectory, including ETF inflows, liquidity conditions, and broader market sentiment. While a retest of the all-time high (ATH) is possible under favorable conditions, all scenarios should be interpreted as analytical observations rather than predictions, with traders monitoring both historical support and model-based resistance for guidance.

24h Most Popular

24h Most Popular

Utilities

Utilities