Gold stablecoins continue to provide an alternative investment vehicle by tracking the price of physical gold. Amid uncertainty, investors have turned to these tokens as a safe haven asset; however, the impacts of tariffs imposed by the U.S. President have led to a decline below record levels. A sudden wave of selling in the market has caused sharp drops in asset values.

The Rise of Gold Stablecoins

Following the announcement of tariffs, a notable sell-off occurred globally in the markets. Large losses in the U.S. stock market on a single day made it challenging for investors to adopt risk-averse strategies. The observed declines in indices have led to anxiety among investors.

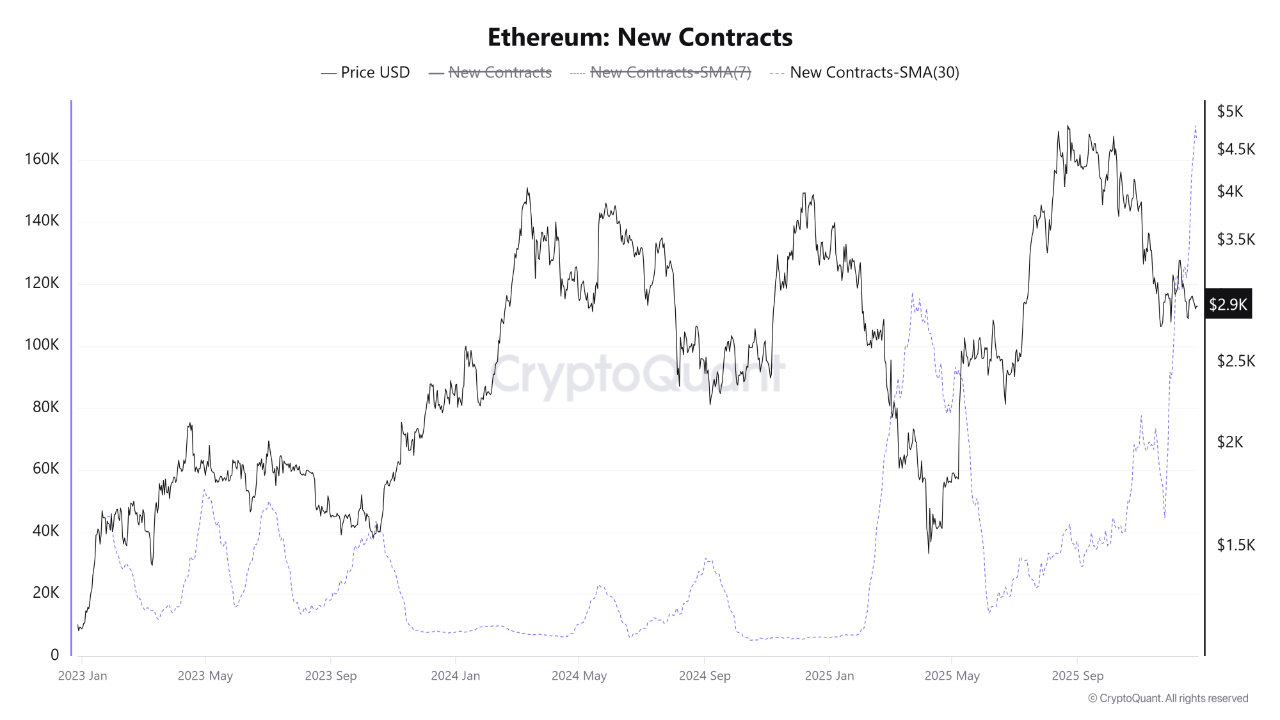

The drop in gold prices has also impacted gold-indexed stablecoins. These stablecoins, which eliminate barriers such as high currency spreads, transaction fees, and the inability to trade 24/7, have gained significant interest recently. They remain unaffected by drastic declines and allow for fast, low-cost transactions akin to investing directly in gold. These advantages signal a potential growth trajectory for gold’s cryptocurrency version, particularly as they cater to individual investors who find access challenging in traditional finance.

Gold Tokens on the Rise

Initially, gold emerged as a preferred safe haven for investors. However, due to high vol...

24h Most Popular

24h Most Popular

Utilities

Utilities