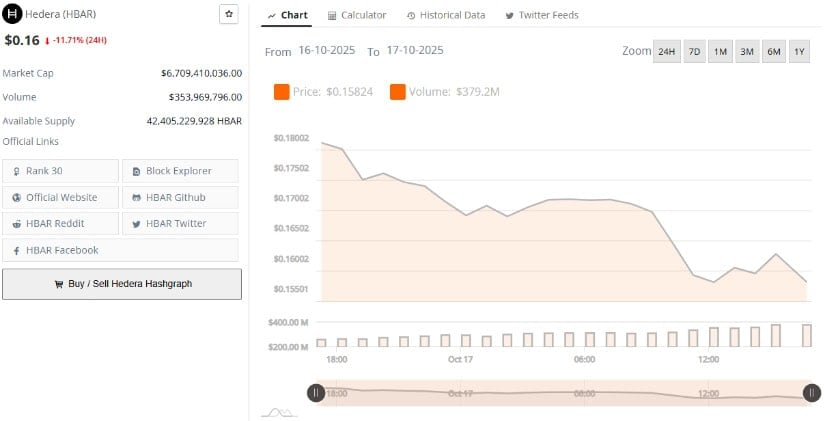

At the time of writing, the coin was priced at $0.16188, reflecting a sharp decline of over 11% in the past 24 hours. Yet despite the bearish tone, several technical cues suggest the asset could be nearing a turning point.

Historical patterns reveal that the asset often experiences prolonged consolidation phases before significant price expansions, leading traders to speculate whether this dip could mark the start of another build-up phase.

Momentum Build-Up Amid Renewed Selling Pressure

Recent price action shows HBAR ($0.18) grappling with renewed selling pressure after a failed attempt to break above its key resistance zone near $0.21. Historically, every decisive move above this threshold has signaled a bullish reversal, while repeated failures have led to extended periods of sideways trading. The current setup mirrors past accumulation phases where volatility increases, volume spikes, and the market prepares for a directional move.

Source: X

Past trends highlighted two major consolidation periods lasting 152 days and 105 days, both followed by strong upward surges. The current structure, while still below resistance, bears resemblance to those setups, implying that the token might be quietly coiling before another push.

Price remains anchored above the $0.15–$0.16 support range, which has so far absorbed heavy selling pressure. A clean breakout and daily close above $0.21 would likely confirm renewed bullish strength, potentially paving the way for a move toward $0.30–$0.35 in the coming months.

Market Structure Points to Hidden Accumulation

Despite the recent drawdown, underlying market data paints a more nuanced picture. Hedera’s market capitalization stands at $6.7 billion, supported by a solid $353 million in daily trading volume, suggesting that participation and liquidity remain healthy even amid the downturn. Such strong activity levels often precede trend reversals, particularly when paired with steady on-chain flows.

Source: BraveNewCoin

The current decline could be masking a quiet accumulation phase. Historically, the coin has displayed similar behavior before large bullish breakouts, an extended range of muted price action followed by rapid expansions. The persistence of capital inflows during sell-offs reinforces this view, hinting that long-term holders may be adding to their positions while short-term traders exit.

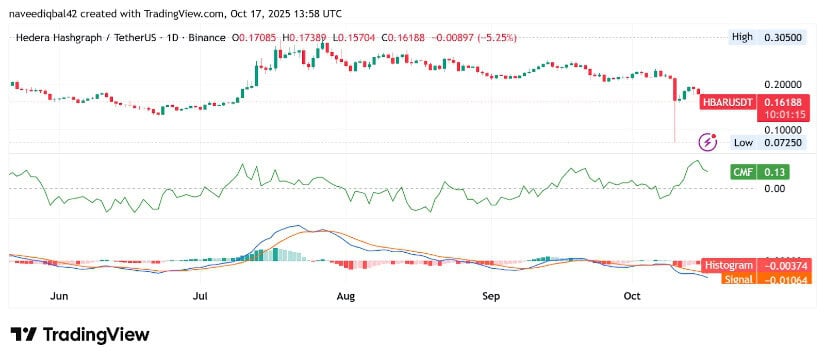

Technical Signals Show Bearish Exhaustion Near Support

At press time, HBAR’s technical indicators reinforce the sense of near-term caution but medium-term opportunity. The Chaikin Money Flow (CMF) currently stands at +0.13, signaling net inflows despite the price weakness, a possible sign that accumulation is occurring beneath the surface. Conversely, the MACD histogram remains negative at –0.0037, while the signal line reads –0.0106, confirming that short-term momentum still leans bearish.

Source: TradingView

However, when positive CMF readings persist during downward pressure, it can often precede a recovery phase, as capital quietly positions for the next move. Volume spikes at key turning points, coupled with tightening price ranges, tend to mark exhaustion in selling pressure. Should the coin reclaim and sustain price levels above $0.21, it could confirm the end of this consolidation period and reestablish bullish control.

24h Most Popular

24h Most Popular

Utilities

Utilities