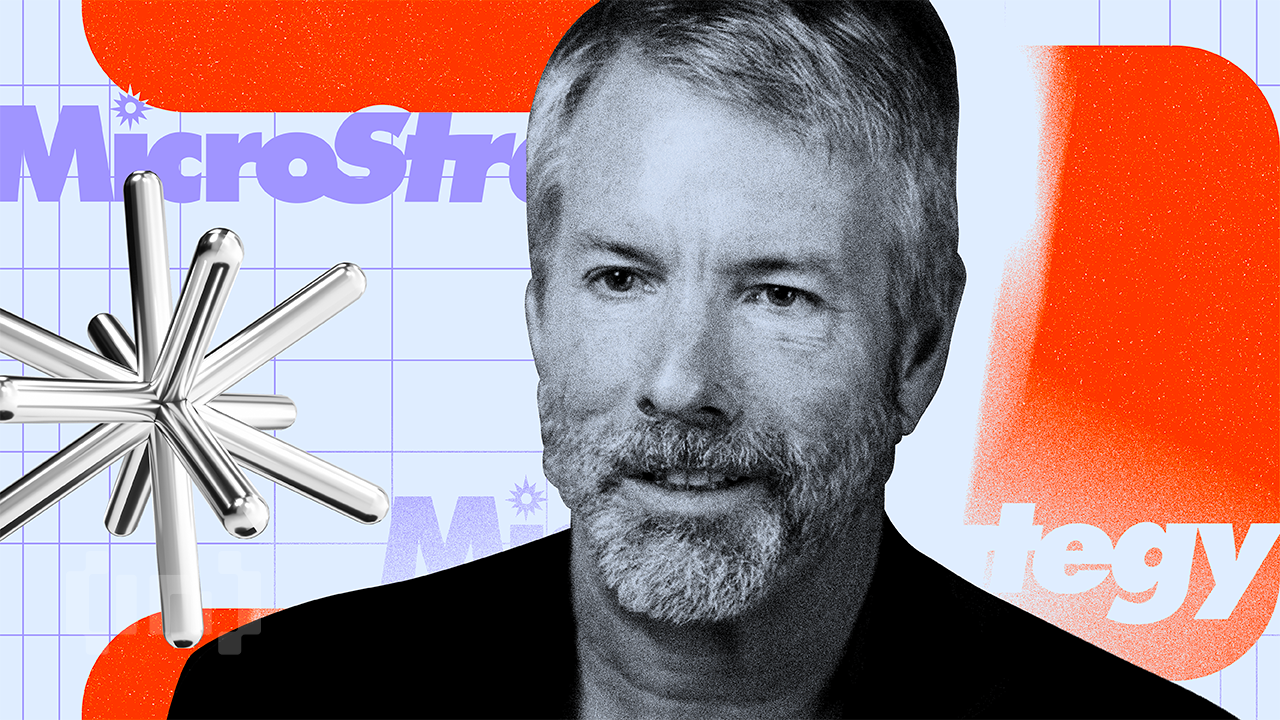

MicroStrategy’s market premium over its Bitcoin holdings has narrowed to near parity, raising questions about the future of Michael Saylor’s levered Bitcoin model.

The latest disclosures show the company holding 649,870 BTC ($87,721.00) at a cost of roughly $48.4 billion, yet its equity no longer trades at the high multiples that powered earlier expansion.

A Collapsing Premium and Rising Capital Pressures

The company’s mNAV fell below 1x in November. mNAV, or market-to-net-asset value, measures how much investors are willing to pay above (or below) the value of Strategy’s underlying Bitcoin.

It matters because Strategy’s entire accumulation strategy depends on issuing equity at a premium—allowing each new share sold to increase Bitcoin per share for existing holders.

MicroStrategy mNav As of November 25, 2025. Source: Saylor Tracker

MicroStrategy mNav As of November 25, 2025. Source: Saylor TrackerThis sharp mNAV reversal follows a broader market downturn. Bitcoin fell more than 30% from its October peak, dropping below $90,000.

Meanwhile, Strategy shares fell faster, reflecting concerns about the company’s reliance on capital markets and rising preferred stock costs.

Strategy’s capital structure has become a central issue. The firm holds only $54 million in cash and owes more than $640 million in annual preferred dividends.

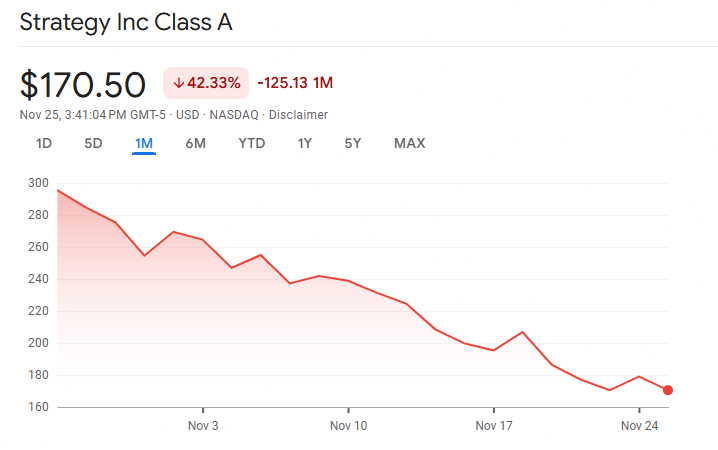

MicroStrategy Stock Price. Source: Google Finance

MicroStrategy Stock Price. Source: Google FinanceThe company’s software business remains cash-flow negative for 2025, widening the gap between obligations and internal liquidity.

As a result, Strategy has leaned on capital markets. It raised about $20 billion in the first nine months of 2025 across convertibles, preferred stock, and at-the-market equity.

That funding kept its Bitcoin accumulation going while servicing older instruments with high and rising coupons.

However, the mechanics that once made this model accretive have weakened. When Strategy traded at large premiums to net asset value, issuing shares increased Bitcoin per share for holders.

That effect disappears when the premium collapses. Issuing stock near NAV risks dilution rather than accretion.

Pressure increased as the cost of capital climbed. The company’s STRC preferred shares raised their dividend from 9% in July to 10.5% in November to maintain par value.

New preferred offerings carry coupons above 10%, with penalty rates up to 18% if unpaid. These terms increase the annual burden and reinforce investor concerns about sustainability.

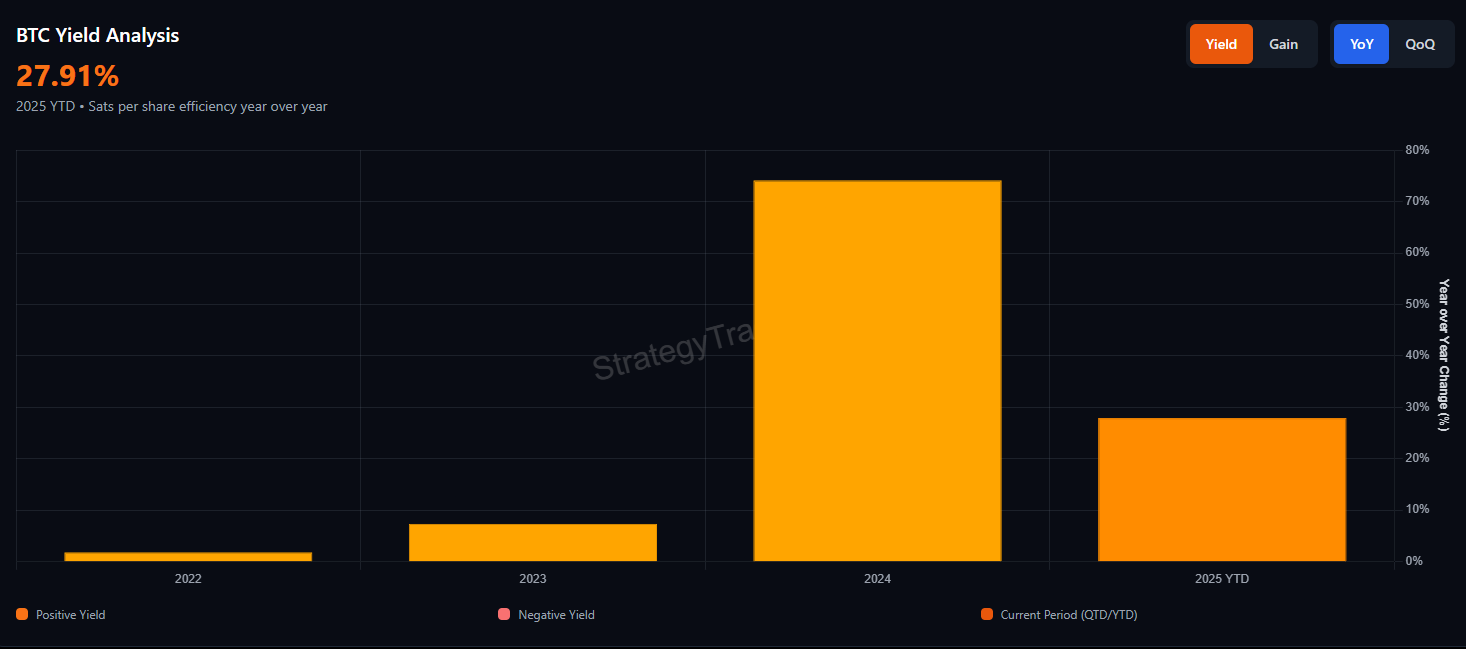

MicroStrategy Bitcoin Yield. Source: Saylor Tracker

MicroStrategy Bitcoin Yield. Source: Saylor TrackerMarket Liquidity, MSCI Risks, and the Future of the Premium

Market confidence further deteriorated after the October 10 crash. Bitcoin dropped about 17% as leveraged liquidations exceeded $19 billion. Order-book depth collapsed across exchanges, highlighting the fragility of liquidity during stress.

For a holder of more than 3% of Bitcoin’s supply, this episode amplified fears about potential forced selling.

The index-inclusion threat compounds the problem. MSCI is consulting on excluding companies with more than 50% of assets in digital currencies from its indices.

Strategy sits near 77% Bitcoin by asset share. JPMorgan estimates such an exclusion could trigger around $2.8 billion in passive outflows, with up to $8.8 billion possible if other index providers follow.

If indices proceed with exclusion in February 2026, MicroStrategy’s mNAV could compress further. Lower premiums reduce the viability of equity issuance, which Strategy has used to manage its obligations and continue accumulation.

A persistent discount would complicate refinancing and weaken the company’s ability to defend its capital structure.

Strategy maintains that its balance sheet offers long-term strength. It recently claimed “71 years” of dividend coverage based on the current market value of its Bitcoin.

However, that calculation assumes frictionless sales, no price impact, and no tax obligations. The October crash demonstrated how quickly liquidity can evaporate under stress.

Will MicroStrategy’s Bitcoin Premium Return?

The narrowing mNAV reflects a market reassessment of leverage, liquidity, and risk. Investors appear less willing to pay a premium for exposure they can now access through spot Bitcoin ETFs without corporate debt and preferred stock layers.

The premium may return if Bitcoin rallies sharply or if index providers soften their stance. Yet the structural pressures remain.

Rising dividend obligations, negative operating cash flow, and a weakening equity premium leave Strategy more exposed than before.

MSTR Vs Bitcoin Performance YTD. Source: Saylor Tracker

MSTR Vs Bitcoin Performance YTD. Source: Saylor TrackerUntil those pressures ease, the market’s message is clear. Investors are no longer paying extra for the Strategy model, and the days of easy accretive issuance appear to be over.

Whether the premium returns now depends on Bitcoin strength, index decisions, and Strategy’s ability to navigate its most difficult period yet.

The post Is MicroStrategy’s mNAV Premium Gone for Good? appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities