The post Japan Becomes 11th Nation to Join the State-Backed Bitcoin Mining Race appeared first on Coinpedia Fintech News

The global race to accumulate Bitcoin is heating up, with nations competing to secure every new coin entering circulation. And Japan just joined in. Once cautious about crypto, the nation is now embracing Bitcoin as part of its energy and digital strategy.

This move places Japan alongside countries like the UAE, Bhutan, and El Salvador, marking a major turning point for Asia’s second-largest economy.

Japan’s 4.5-Megawatt Bitcoin Mining Initiative

Following the announcements Japan has officially become the 11th nation to recognize Bitcoin as a strategic asset. The country launched a 4.5-megawatt, government-backed Bitcoin mining project in collaboration with Canaan Inc. and a state-owned utility provider.

The project will use hydro-cooled Avalon A1566HA rigs and operate by late 2025, harnessing excess renewable energy from solar and wind sources.

Led by Japan’s Ministry of Economy, Trade, and Industry (METI), the government’s pilot mining initiative will focus on utilizing surplus renewable energy from regional utility providers. This approach aims to balance energy efficiency with national crypto adoption goals while mitigating the carbon footprint often associated with Bitcoin

The project is expected to launch by late 2025, the project will act as a digital load balancer, adjusting mining operations based on power supply

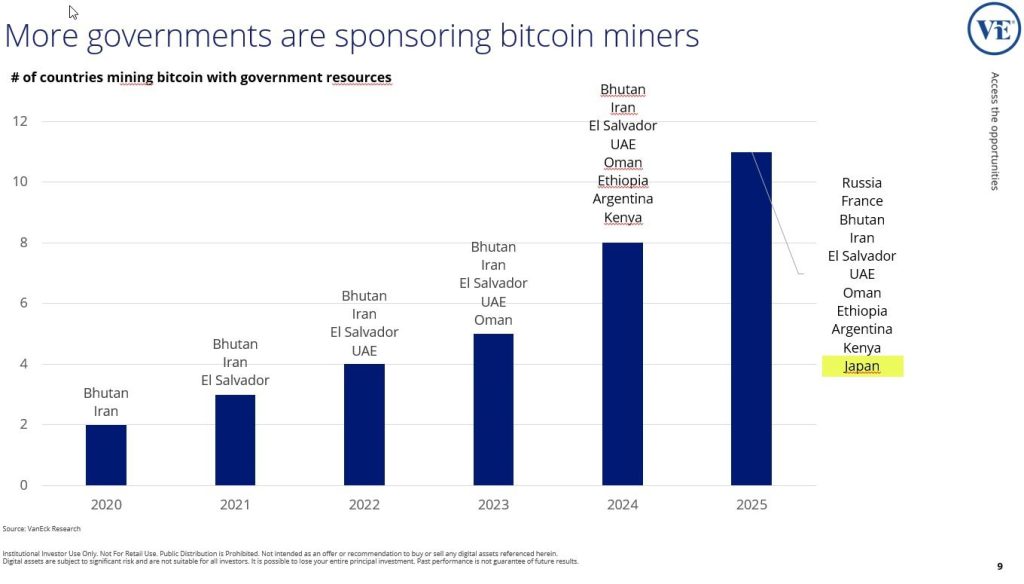

Governments Are Now Mining Bitcoin

For years, governments viewed Bitcoin as something to regulate or tax. Now, they’re starting to mine it themselves. According to VanEck Research, the number of nations involved in government-backed Bitcoin mining has surged from just two in 2020 to eleven by 2025.

Countries like Russia, France, Bhutan, Iran, El Salvador, the UAE, Oman, Ethiopia, Argentina, and Kenya, that are actively sponsoring Bitcoin mining through direct government participation or state-owned enterprises.

The Impact on Bitcoin’s Price

Rising institutional ETF demand and growing government-backed mining could push Bitcoin into a new demand cycle, where limited supply meets large-scale accumulation.

With April 2024 halving already cutting new supply, this surge in sovereign mining may tighten circulation even more. Analysts now expect Bitcoin to reach between $160,000 and $200,000 by the end of 2025, supported by steady institutional inflows and national-level adoption.

As of now, Bitcoin is trading around $103,163, showing a 2% gain over the past 24 hours

24h Most Popular

24h Most Popular

Utilities

Utilities