Strategy (formerly MicroStrategy) traded below the value of its Bitcoin holdings this week, signalling rare investor caution toward the largest corporate holder of BTC ($92,445.00).

The stock slipped to an intraday market cap of about $65.34 billion, falling under the $66.59 billion value of its 641,692 Bitcoin.

Worrying Signs For MicroStrategy?

This created a temporary negative premium. It showed that equity markets priced MicroStrategy’s corporate and dilution risks higher than the value of its digital assets.

The move stands out because MicroStrategy usually trades above the value of its holdings.

MicroStrategy Stock Price. Source: Google Finance

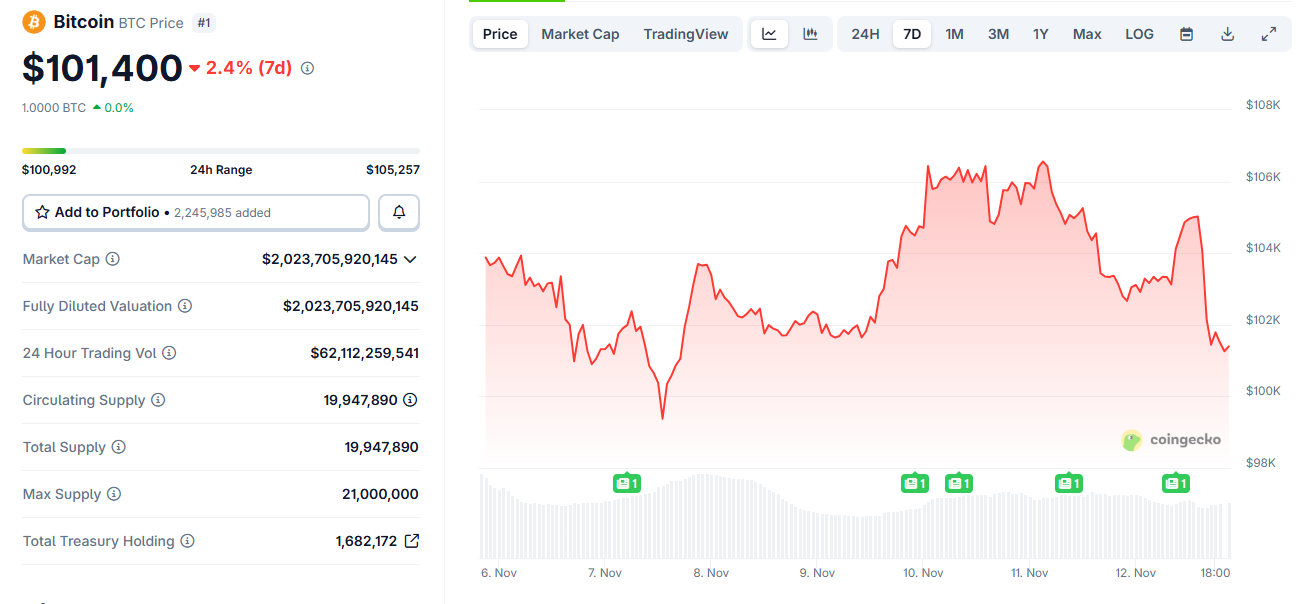

MicroStrategy Stock Price. Source: Google FinanceBitcoin markets added more context. BTC hovered between $100,000 and $105,000 during the week, drifting about 2% lower.

Sentiment remains fragile, with the crypto Fear and Greed Index sitting in extreme fear territory.

Despite that cautious backdrop, Bitcoin held a tighter range than MicroStrategy’s stock. Traders viewed BTC as the cleaner exposure while treating MicroStrategy as a leveraged proxy.

This divergence strengthened as MicroStrategy continued raising capital through equity and preferred share offerings.

Moreover, the company recently added another 487 BTC for $49.9 million. The purchase kept its long-term strategy unchanged, even as its stock faced selling pressure.

Investors appeared concerned about future dilution and the firm’s growing leverage.

However, the discount was short-lived. MicroStrategy’s stock quickly moved back above its effective net asset value.

Even so, the event highlighted a shift in behaviour among institutional traders.

The market is rewarding direct Bitcoin exposure over corporate structures that hold Bitcoin. It also signals that equity investors now differentiate between BTC as an asset and MicroStrategy as a business with operational and financing risks.

Bitcoin 7-Day Price Chart. Source: CoinGecko

Bitcoin 7-Day Price Chart. Source: CoinGeckoFor Bitcoin holders, the episode reinforces the asset’s relative strength despite weak sentiment.

For equity investors, it shows that Strategy may face more volatility than Bitcoin itself as its capital strategy expands.

The event marks a subtle shift in market psychology. Investors still value MicroStrategy’s large Bitcoin position, but they are no longer paying a consistent premium for its leverage.

The post MicroStrategy Briefly Worth Less Than Its Bitcoin as Market Flags Corporate Risk appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities