Pi Coin price is showing early signs of support after a sharp mid-December drop. Since the December 16 low, Pi Coin has bounced over 8%, helped by steady exchange-side buying.

But while buying pressure has picked up, not all capital groups are convinced yet. The result is a market caught between support and hesitation, setting up a likely range move rather than a clean breakout. Right now, Pi Coin sits at a crossroads where inflows are improving, but conviction remains uneven.

Buying Pressure Builds as Capital Flows Turn Supportive

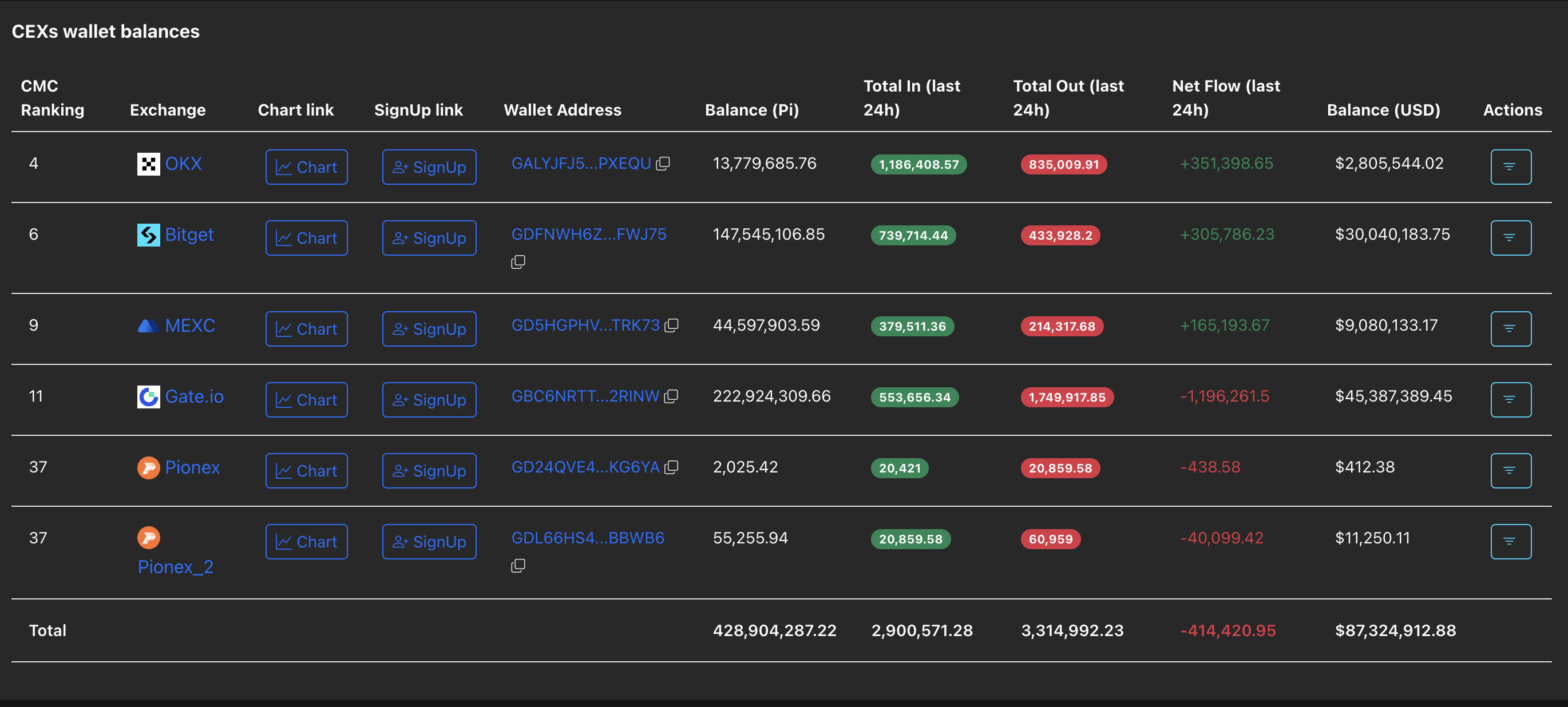

Exchange wallet data shows clear net buying over the past 24 hours.

Across major centralized exchanges, Pi Coin recorded a net outflow of roughly 414,420 PI ($0.21), meaning more tokens left exchanges than entered. That usually points to buying rather than selling.

At current prices, this net buying represents approximately $83,000 in accumulation over a short period. Despite being a small exchange-based purchase, it is significant given PI’s seller-driven history.

Net Buying Across CEXs: Pi Scan

Net Buying Across CEXs: Pi ScanWant more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Flow-based momentum supports this shift.

The Chaikin Money Flow (CMF) indicator has risen by over 40% from its recent lows. CMF tracks whether big money is flowing into or out of an asset. Rising CMF alongside price stabilization suggests that large buyers are absorbing supply rather than chasing price.

The combined rise in buying pressure could have helped Pi Coin recover nearly 8% from its December 16 low, pushing the price back above the $0.19 line.

Big Money Flows Surges: TradingView

Big Money Flows Surges: TradingViewCMF is also nearing a breakout from a descending trendline. A clean break above that line, followed by a move above the zero level, would strengthen the case that this bounce has real backing. So far, the signals say buying is real, but still measured.

Why Pi Coin Price Likely Stays Range-Bound

Despite improving flows, smart money behavior remains cautious. The Smart Money Index continues to trend lower and has not confirmed the recent price rebound. That indicates that informed, longer-term buyers are not yet aggressively stepping in.

When buying pressure rises without smart money confirmation, the price often stabilizes instead of trending immediately.

Pi Coin Must Gain Smart Money Attention: TradingView

Pi Coin Must Gain Smart Money Attention: TradingViewThat matches Pi Coin’s current structure.

The key support zone sits near $0.19, which has held multiple tests. A clean break below it would reopen downside risk toward $0.15.

On the upside, $0.21 acts as the first barrier. Without a strong push above that level, rallies are likely to stall.

Pi Coin Price Analysis: TradingView

Pi Coin Price Analysis: TradingViewThis creates a roughly 10% range, with about 5% upside and 5% downside from current prices.

In short, Pi Coin is being supported by steady buying and improving money flow, but the lack of smart money participation suggests consolidation rather than continuation. Until that changes, Pi Coin is more likely to trade sideways than trend hard in either direction.

The post Pi Coin Likely to Consolidate in a Tight Range as Buying Rises Without Strong Conviction appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities