An anonymous trader burned through $3 million in minutes on Hyperliquid after faking a $20 million buy wall on POPCAT.

The move triggered a cascade of liquidations, resulting in a $4.9 million loss for the platform’s liquidity provider. Analysts now suspect a coordinated “stress test” of Hyperliquid’s system.

$30 Million Long Positions Create Chaos

The incident began when an unknown trader withdrew $3 million USDC ($1.00) from the OKX exchange, splitting it across 19 separate wallets before depositing it into Hyperliquid DEX.

Using these accounts, the trader opened massive long positions on POPCAT, leveraging them approximately 5x. Total exposure reached around $26–30 million, briefly making POPCAT one of the most actively traded tokens on the platform.

According to blockchain intelligence firm Arkham, the trader’s positions were quickly liquidated, resulting in the loss of almost all collateral.

“Someone just passed $5 million of bad debt on POPCAT to Hyperliquid’s Hyperliquidity Provider (HLP)…These 19 accounts were liquidated for a combined $25.5 million of POPCAT, losing $2.98 million in collateral,” Arkham reported.

The on-chain tracker also revealed that HLP lost $4.95 million, a move that effectively closed out remaining positions.

Fake Buy Wall Sparks Mass Liquidations

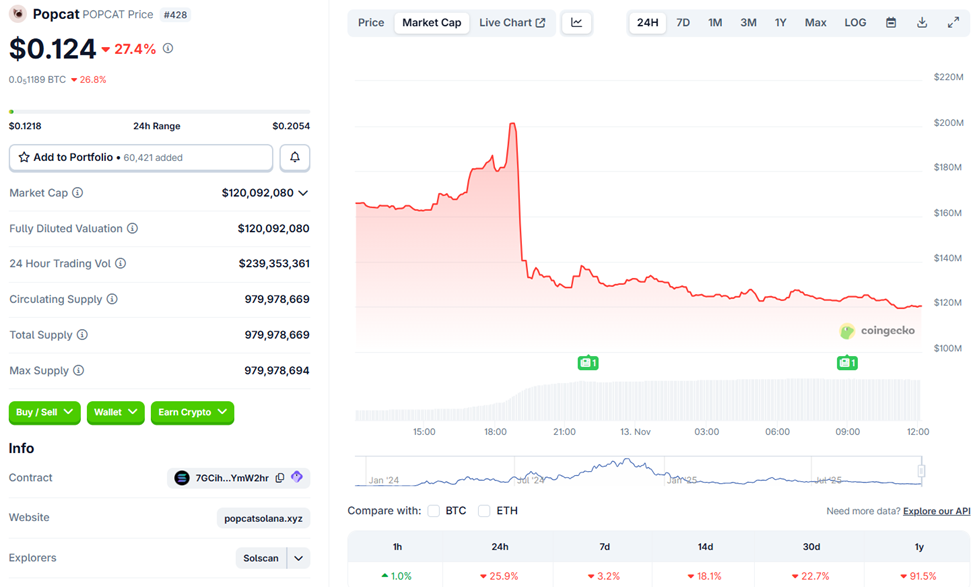

To amplify the chaos, the trader placed a $20 million buy wall at $0.21, creating the illusion of strong demand. As of this writing, the POPCAT price was trading for $0.12, down by almost 30% in the last 24 hours.

This strategic move attracted other traders to enter long positions, as they believed in a bullish momentum. Within minutes, the buy wall vanished, causing POPCAT’s price to collapse.

POPCAT Price Performance. Source: CoinGecko

POPCAT Price Performance. Source: CoinGeckoThe sudden drop triggered mass liquidations across the market, with HLP absorbing the brunt of the losses.

“The attacker then placed an approximately $20 million buy wall near $0.21, creating the illusion of strong demand — only to cancel the orders, triggering a liquidity collapse that led to mass liquidations. HLP absorbed the positions and lost around $4.9M, while the attacker’s entire $3M stake was wiped out,” blockchain analyst Lookonchain noted.

Stress Test or Deliberate Attack?

Many in the crypto community suspect this was no accident. Vikas Singh, who observed the event live, compared it to previous manipulative scenarios, such as JellyJelly 2.0, noting the unusual stability of the long wall and its manual maintenance.

Analysts speculate this could have been a targeted stress test to probe Hyperliquid’s automated liquidity systems.

Some community members even speculated about Binance’s former CEO CZ’s involvement. However, CZ responded directly, denying any connection.

“I have not used any other CEX for 8 years,” the Binance executive articulated.

This marks the third major market incident on Hyperliquid this year, raising questions about how the exchange handles liquidity concentration and systemic risk. High-leverage meme tokens, such as POPCAT, are inherently risky and could expose vulnerabilities in decentralized liquidity systems.

Reportedly, the incident also sparked a temporary pause on Hyperliquid’s Arbitrum bridge, though deposits and withdrawals continued unaffected.

DeFi analyst Hanzo suggests exchanges may need stricter leverage limits, real-time monitoring tools, or platform-specific restrictions to mitigate similar attacks in the future.

While Hyperliquid’s team manually stabilized the market, the incident exposes the fragility of automated liquidity mechanisms in high-leverage meme markets.

The post POPCAT Flash Crash on Hyperliquid Sparks $4.9 Million Manipulation Allegations appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities