Ripple has acquired Palisade, a digital asset custody platform, marking another key addition to its acquisition streak this year.

The company did not share financial details of the deal. However, it revealed that it has invested around $4 billion in the crypto ecosystem through investments, mergers, and acquisitions.

Palisade Purchase Expands Ripple’s Reach

Ripple made the acquisition to enhance its custody services, targeting financial institutions, corporates, and crypto-native firms. This move integrates Palisade’s wallet-as-a-service technology with Ripple Custody and Ripple Payments, strengthening Ripple’s position in institutional digital asset infrastructure.

“Secure digital asset custody unlocks the crypto economy and is the foundation that every blockchain-powered business stands on—that’s why it’s central to Ripple’s product strategy,” Ripple’s President, Monica Long, stated.

Palisade offers advanced features, including Multi-Party Computation (MPC), zero-trust architecture, multi-chain support, and DeFi integration. This integration will enable Ripple to provide high-speed wallet provisioning, scalable infrastructure, solutions for subscription payments, and real-time transactions.

Palisade’s API-first architecture complements Ripple’s existing offerings, which are already trusted by leading banks such as Absa, BBVA, DBS, and Societe Generale, as well as FORGE and others.

“The combination of Ripple’s bank-grade vault and Palisade’s fast, lightweight wallet makes Ripple Custody the end-to-end provider for every institutional need, from long-term storage to real-time global payments and treasury management,” Long added.

Ripple’s Strategic Investments in 2025

The Palisade deal follows several notable acquisitions that reshaped Ripple’s services. BeInCrypto reported that the firm completed the $1.25 billion acquisition of Hidden Road in late October.

The company rebranded it as Ripple Prime and launched institutional over-the-counter (OTC) trading for digital assets in early November. Additionally, Ripple spent $1 billion to acquire treasury management software provider GTreasury. It has also agreed to buy Rail for $200 million.

Ripple’s string of acquisitions comes during a surge in crypto M&A deals. Architect Partners reported that in Q3, crypto M&A totaled over $10 billion—a 100% increase from the prior quarter. This activity was heightened by regulatory changes following Trump’s presidency.

“For the second quarter in a row, seven announced transactions over $100 million, excluding deSPAC reverse mergers,” Architect Partners highlighted.

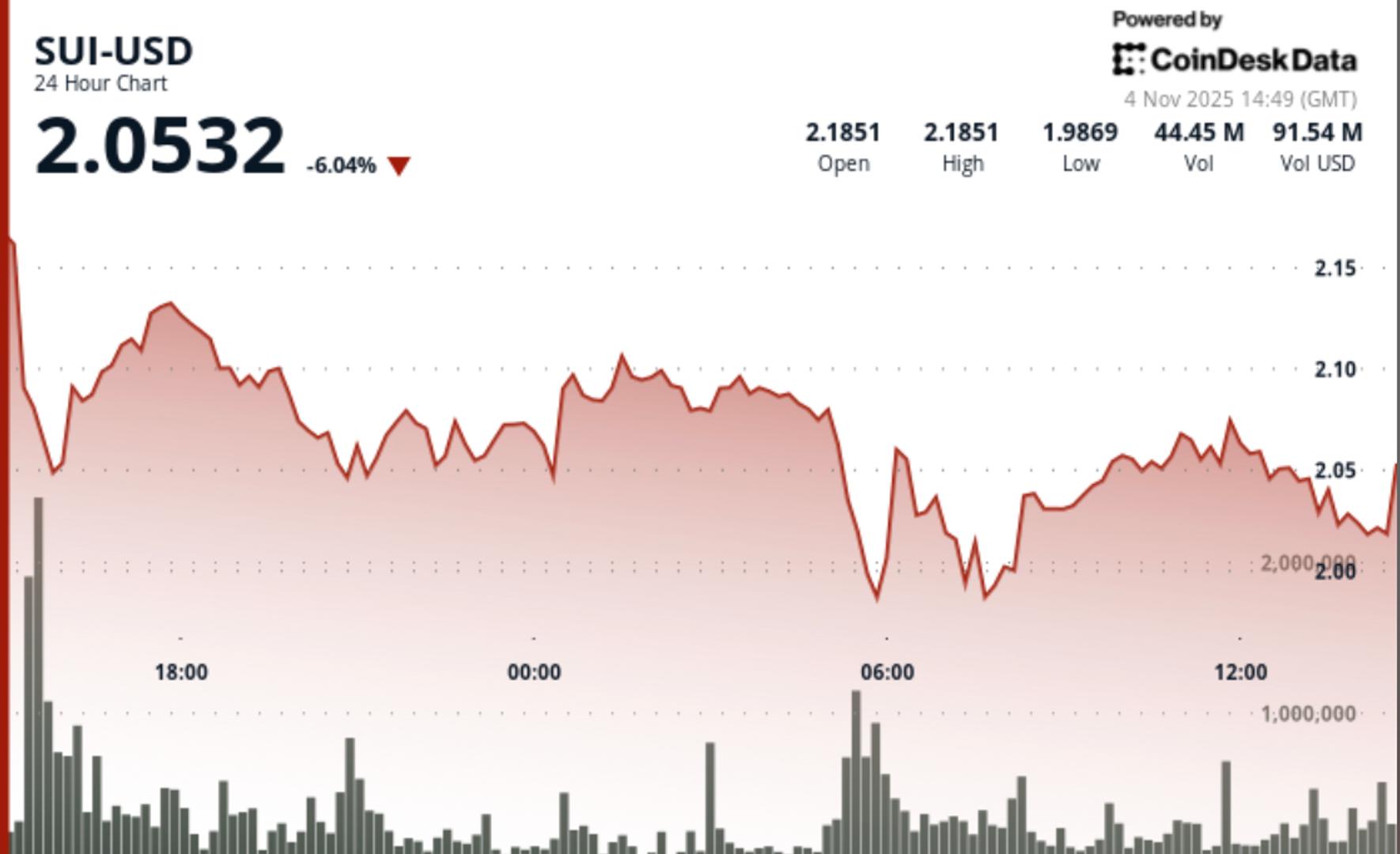

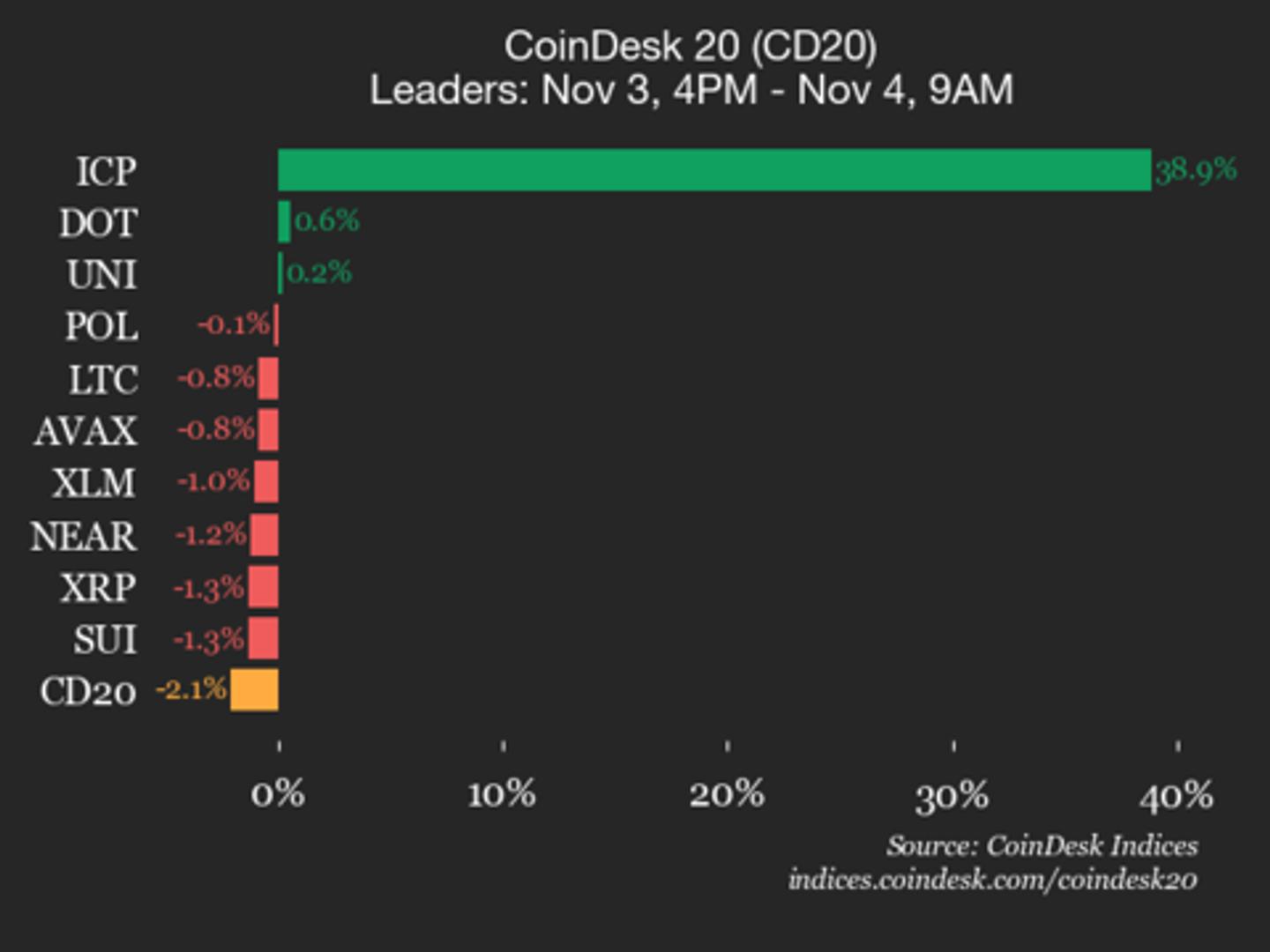

Despite Ripple’s growth, XRP ($2.26) continues to face market volatility. Amid the broader market drop, XRP has lost 5.46% of its value, extending its weekly decline to nearly 15%. At press time, it was trading at $2.27.

XRP Price Performance. Source: BeInCrypto Markets

XRP Price Performance. Source: BeInCrypto MarketsAs Ripple expands its institutional business—spanning custody, payments, and prime brokerage—questions around the gap between the company’s corporate growth and XRP’s price performance remain. The upcoming months will reveal whether Ripple’s investments drive real demand for XRP.

The post Ripple Makes Another Key Acquisition While XRP Extends 15% Weekly Slide appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities