Satoshi Nakamoto’s legendary Bitcoin fortune has dropped by an estimated $41 billion, as BTC ($87,712.00)’s price slid more than 30% from its all-time high.

The pseudonymous creator’s 1.1 million Bitcoin, tracked using the Patoshi mining pattern, fell from $138 billion in October to about $96 billion as of this writing. This sharp decline moved Satoshi from 11th to around 20th among the world’s wealthiest people, now just below Bill Gates.

BTC Price Crashed, But What Happened to Satoshi’s Bitcoin Stash

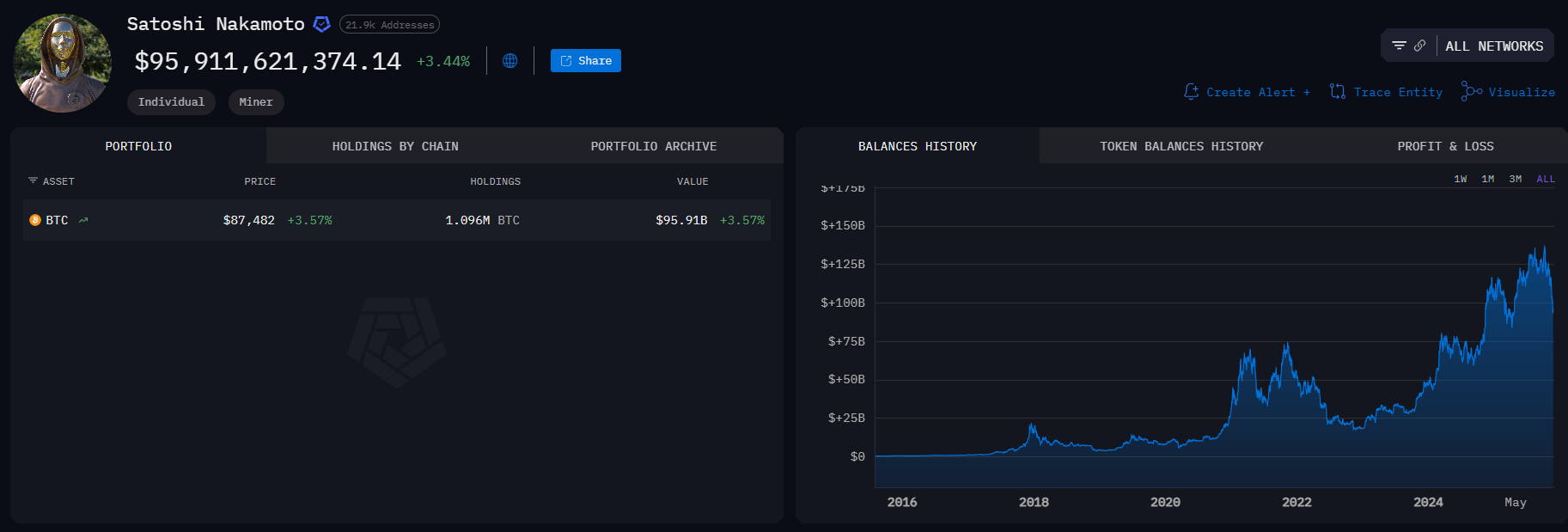

Arkham Intelligence, a blockchain analytics firm, estimates Satoshi’s Bitcoin using mining analysis and on-chain forensics.

The “Patoshi Pattern,” discovered by Sergio Lerner, identifies more than 22,000 early addresses likely controlled by one entity, widely believed to be Satoshi Nakamoto. These coins, untouched for over a decade, continue to fuel intense speculation.

As of October 6, 2025, when the pioneer crypto established an all-time high of $126,296, Satoshi’s Bitcoin stash was valued at $138.92 billion. However , Bitcoin’s price has since dropped by over 30% to trade for $87,390 as of this writing.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingViewWith this drop, Satoshi’s Bitcoin stash has shrunk to $96.129 billion, meaning $42.79 billion of this fortune disappeared in weeks.

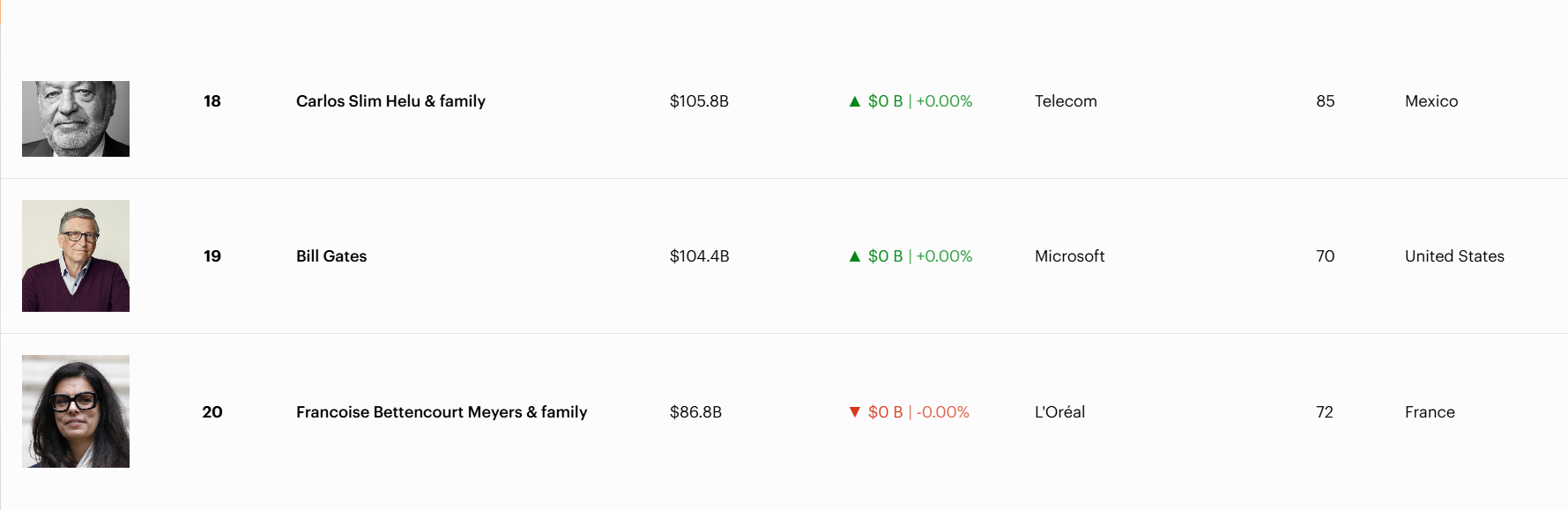

If Forbes listed Satoshi among the list of the world’s richest people, the Bitcoin founder would rank just below Bill Gates and right above Françoise Bettencourt Meyers & family at position 20.

Satoshi’s Place Among Richest People in the World. Source: Forbes

Satoshi’s Place Among Richest People in the World. Source: ForbesDespite the vast scale of Satoshi’s holdings, Forbes and other wealth trackers do not count the Bitcoin founder in their official billionaire lists. The reasons include Satoshi’s unverified legal status and the fact that the assets have remained dormant, leaving ownership questions unresolved.

“Forbes does not include Satoshi Nakamoto on our Billionaire rankings because we have not been able to verify whether he or she is a living person, or one person vs. a collective group of people,” the magazine told BeInCrypto.

Ironically, Satoshi’s coins remain among the most visible fortunes due to the blockchain’s transparency.

Satoshi’s Bitcoin Holdings. Source: Arkham

Satoshi’s Bitcoin Holdings. Source: ArkhamSome experts suggest Forbes and others should consider including pseudonymous crypto wallets in their lists, even though ownership is anonymous.

Nonetheless, the long-term dormancy has also led to speculation that the fortune could be lost, inaccessible, or deliberately abandoned, an unusual scenario among billionaires.

Quantum Threats and Satoshi’s Secret

Elsewhere, the rise of quantum computing has renewed debate about Satoshi’s future and potential identity. Because quantum computers might one day break early Bitcoin cryptography, some experts propose freezing Satoshi’s coins or forking the network before a possible “Q-Day.” If these risks emerge, the controller of these coins may need to surface.

Nakamoto’s enigma will reach a global audience in 2026 with “Killing Satoshi,” a film exploring the mystery and geopolitical implications of dormant Bitcoin wealth.

Until these coins are moved or declared lost, Satoshi’s fortune remains a symbol of Bitcoin’s origins and its greatest secret.

If Bitcoin surges to $320,000–$370,000, Satoshi could become the world’s richest person. For now, the fortune remains unchanged for over 15 years, highly visible, but untouched.

The post Satoshi Nakamoto Loses $43 Billion as Bitcoin Price Falls Over 30% appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities