BitMine Immersion Technologies announced its crypto and cash holdings have reached $13.2 billion, driven by a sharp increase in Ethereum accumulation.

The company said it now owns 3.5 million ETH ($3,546.26), worth about $12.7 billion, along with 192 BTC ($105,799.00), a $61 million stake in Eightco Holdings, and $398 million in cash.

Tom Lee Confirms Strategic Expansion

At this level, BitMine controls roughly 2.9% of Ethereum’s total supply. This makes Tom Lee’s firm the largest ETH treasury in the world and second-largest overall behind MicroStrategy’s Bitcoin holdings.

“We acquired 110,288 ETH tokens over the past week, 34% more than the week prior,” Lee said. “This pushed our holdings to 3.5 million ETH—halfway towards our goal of 5% of the supply.”

Tom Lee described Ethereum as the foundation for the next financial super cycle, citing institutional interest in on-chain asset tokenization.

Last week, BitMine and the Ethereum Foundation co-hosted an event at the New York Stock Exchange, attended by leading financial institutions.

Lee compared 2025’s regulatory shifts, such as the GENIUS Act and SEC Project Crypto, to the US decision in 1971 to end the gold standard.

He calls it a pivotal modernization moment for financial markets.

Shift from Bitcoin Mining to Ethereum Treasury

BitMine was originally a Bitcoin mining and hosting firm using immersion-cooled facilities in Texas and Trinidad. The company continues to mine Bitcoin and host third-party miners under its “Mining-as-a-Service” program.

However, it has steadily repositioned itself as a crypto investment and treasury management company. Its business now blends mining infrastructure with strategic accumulation of ETH and BTC for long-term value.

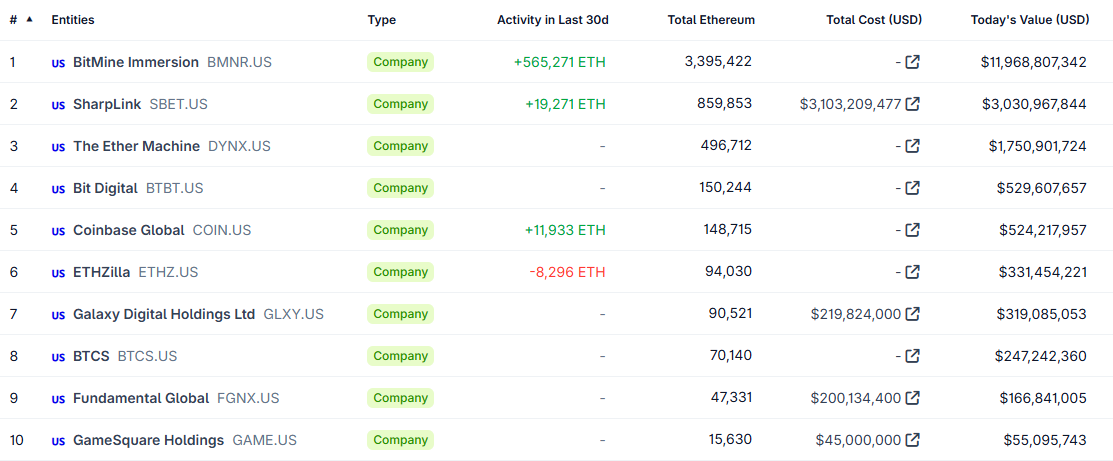

Top 10 Ethereum Treasury Companies. Source: CoinGecko

Top 10 Ethereum Treasury Companies. Source: CoinGeckoAnalysts view BitMine’s approach as similar to MicroStrategy’s Bitcoin treasury model, but centered on Ethereum’s broader use in DeFi, stablecoins, and tokenized assets.

Stock Sees High Volatility but Strong Liquidity

BitMine’s stock has been one of the most actively traded US equities in 2025. It recently traded near $42, down from its October high above $56, but still up more than 300% since July.

According to Fundstrat, BMNR averaged $1.6 billion in daily trading volume last week, ranking 48th among all US-listed stocks. That places it just behind Lam Research and ahead of Arista Networks.

BMNR Stock Price Chart In 2025. Source: Google Finance

BMNR Stock Price Chart In 2025. Source: Google FinanceThe stock’s rally began after Peter Thiel disclosed a 9.1% stake in July, signaling growing institutional confidence.

Still, its valuation remains tied to Ethereum’s price performance and overall market sentiment.

The post Tom Lee’s BitMine Boosts Ethereum Holdings Amid Market Dip appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities