Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because markets are anything but calm this week. Between shifting whale positions, record Bitcoin sell-offs, and a high-stakes Fed decision, traders are bracing for fireworks as bulls and bears fight for control of the next big crypto move.

Crypto News of the Day: Whales Reshuffle, Holders Dump, and Traders Brace for Powell’s Call

Crypto markets are bracing for turbulence as whales reshuffle positions and long-term holders cash out ahead of a pivotal Federal Reserve meeting. With traders split between risk and restraint, Bitcoin’s next big move may depend as much on Jerome Powell as on whale psychology.

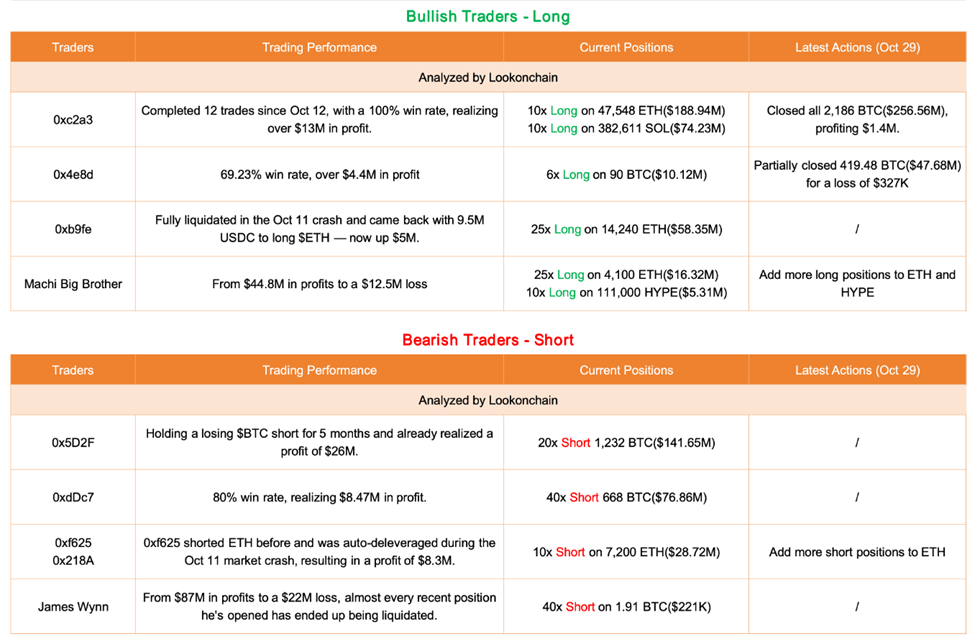

According to Lookonchain, one whale wallet known for a 100%-win rate closed all 2,186 BTC ($111,813.00) ($256.56 million) in long positions with only a modest $1.4 million profit. This is a rare sign of caution from a trader typically known for precision timing.

Another whale, “0x4e8d,” exited $47.68 million worth of longs at a loss, while others like Machi Big Brother doubled down on ETH ($4,006.05) and HYPE ($47.98) longs. Meanwhile, a familiar short-seller who earned $8.3 million during October’s crash has reopened ETH shorts, suggesting expectations of renewed downside pressure.

At the same time, long-term Bitcoin holders are quietly unloading. According to CryptoQuant analyst JA Maartun, long-term investors have sold 325,600 BTC in the last 30 days, marking the sharpest drawdown since July 2025.

This wave of profit-taking contrasts sharply with accumulation trends seen among whales, who appear to be buying the dip.

It is a complex moment in which conviction and caution coexist, with some taking profits while others are positioning for a rebound.

Adding to the uncertainty, Sequan, a corporate entity holding Bitcoin as part of a treasury strategy, dumped 970 BTC ($112 million), its first sale since adopting a Bitcoin Treasury Strategy.

Meanwhile, a separate whale with a 100%-win rate reportedly closed an ETH 5x long for $1.63 million profit and increased exposure to SOL ($198.14), betting on a short-term recovery.

Analyst Joao Wedson noted that aggregated liquidation levels show a clear split in sentiment. In the short term, many traders are positioned long between $109,000–$105,000, while medium-term shorts around $127,000 remain in profit.

“Today’s drop is to liquidate the impatient ones…but the next big flush will likely target the confident ones,” he wrote on X.

With the Federal Open Market Committee (FOMC) meeting just hours away, markets expect a 25-basis-point rate cut. Jerome Powell will speak at 2:30 PM ET.

Traders are on edge, torn between anticipating renewed liquidity and fearing hawkish signals that could extend volatility into November.

China Tensions Add to Market Anxiety

Beyond the Fed, geopolitics is also reshaping market sentiment. China purchased 180,000 tons of US soybeans in its first major order in months, a gesture seen as goodwill ahead of President Donald Trump’s highly anticipated meeting with Xi Jinping.

The summit comes as Trump signals a potential tariff rollback on Chinese chemical imports tied to fentanyl production. Analysts view the move as a possible breakthrough toward a broader US–China trade deal.

“I expect to be lowering that because I believe they can help us with the fentanyl situation,” Trump reportedly said aboard Air Force One.

Even prediction markets are getting creative. One high-rolling trader on Polymarket, who previously made $13 million betting on Trump’s election win, reportedly placed a massive wager on the duration of the Trump–Xi handshake.

Crypto markets, meanwhile, are holding steady but cautious. Analysts say that confirmation of a trade deal could reignite bullish momentum across Bitcoin, Ethereum, and equities, potentially setting the stage for the next major rally once the dust from the FOMC settles.

Chart of the Day

Bullish versus Bearish Traders. Source: Lookonchain on X

Bullish versus Bearish Traders. Source: Lookonchain on XByte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Central banks anchor metals rally: Is silver poised to outshine gold in next Supercycle?

- Is Bitcoin outgrowing its 4-year cycle? 2026 could mark a turning point.

- S&P 500 hits 6,900 on weak breadth — But is crypto the real liquidity play?

- Robert Kiyosaki says Bitcoin could double in 2025.

- Stablecoin giant Tether now holds more US Treasuries than South Korea and the UAE.

- Ethereum LTH selling in October hits 3-month high — What’s next for price?

- World Liberty Financial unveils 8.4 million WLFI ($0.15) token airdrop amid price slump.

- Whales split on Ethereum: Profit-takers sell as Bitmine bets big with $113 million buy.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 28 | Pre-Market Overview |

| Strategy (MSTR) | $284.64 | $285.20 (+0.20%) |

| Coinbase (COIN) | $355.22 | $356.48 (+0.35%) |

| Galaxy Digital Holdings (GLXY) | $37.29 | $37.64 (+0.94%) |

| MARA Holdings (MARA) | $18.18 | $19.00 (+0.74%) |

| Riot Platforms (RIOT) | $21.56 | $21.73 (+0.81%) |

| Core Scientific (CORZ) | $20.09 | $20.41 (+1.59%) |

The post Whales Stir Chaos as Bulls and Bears Face Off Before FOMC | US Crypto News appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities