</a>-Price-is-Down-Today-Heres-Where-it-May-Reach-1024x536.webp)

The post Bitcoin Bloodbath: BTC Price Plunges Below $100K as Whales Vanish and Traders Brace for More Selloff appeared first on Coinpedia Fintech News

Bitcoin (BTC) has teased the potential onset of its bear market after dropping to a four-month low. The flagship coin dropped over 5% on Tuesday, November 4, to reach a range low of around $99,955 before rebounding to trade about $101k at press time.

The sudden Bitcoin price selloff influenced the wider altcoin market led by Ethereum (ETH ($3,139.67)), XRP ($2.11), BNB ($900.39), and Solana (SOL ($148.67)). As such, the total crypto market cap has shed nearly $400 billion in valuation during the past 24 hours.

Why is Bitcoin Price Dropping Today?

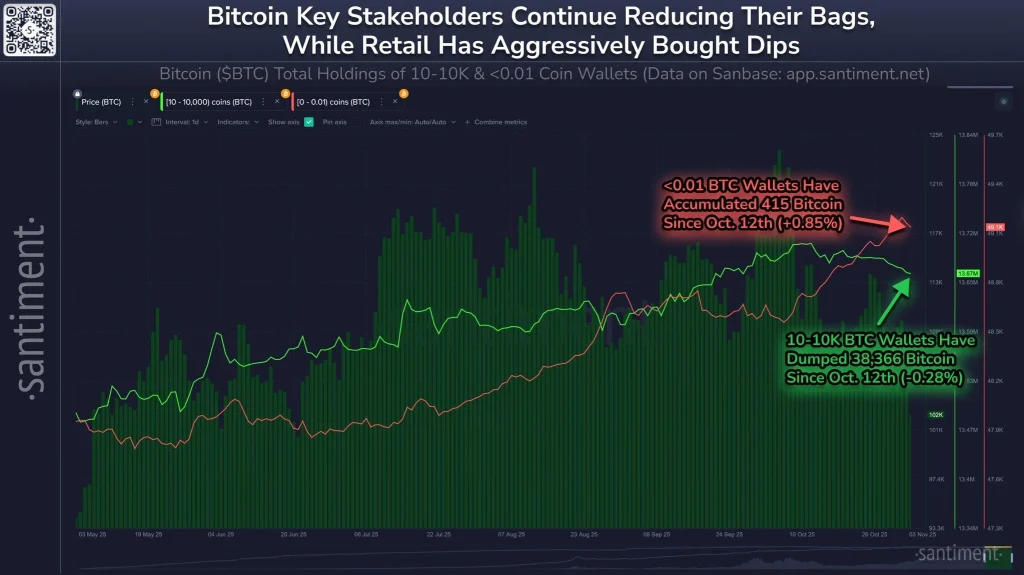

Whale capitulation amid retail conviction

According to on-chain data analysis, Bitcoin whales have accelerated booking profits in the recent past while retail traders have continuously bought the dips. Bitcoin wallets with a balance of between 10 and 10k sold nearly 38.4k BTCs since October 12 to date.

Source: Santiment

Meanwhile, retail traders, with a balance of above 0.01 BTCs have accumulated 415 coins since October 12.

“Bulls need to see this trend completely flip in order to expect a sustained price rebound for all of crypto. Markets rise when key stakeholders accumulate the coins that small wallets shed,” Santiment noted.

Heavy long liquidation: long squeeze inbound

Following the ongoing crypto bloodbath, more than $1.1 billion was liquidated from leveraged traders. Notably, around $1.01 billion involved long traders, thus fueling the impact of a long squeeze.

Midterm fear of further capitulation to fill a CME gap at $92k

Following the sustained choppy crypto market, CoinMarketCap’s Fear and Greed index dropped to around 27/100, signaling extreme traders’ fear.

The fear of further capitulation is heavily rooted in the fact that the Bitcoin CME Futures has an unfilled gap between $92k and $93k.

24h Most Popular

24h Most Popular

Utilities

Utilities