On Tuesday, Metaplanet announced a $500 million credit facility backed by Bitcoin to support long-term BTC ($88,972.00) holdings and improve capital efficiency. The company also continues its ¥75 billion ($500 million) share repurchase program.

The announcement reflects its growing role as a publicly traded Bitcoin treasury company in Japan. However, some industry observers have raised concerns regarding potential collateral and market volatility risks.

Bitcoin-Backed Credit Facility Enhances Capital Strategy

Metaplanet, listed on the Tokyo Stock Exchange (3350.T), had established a significant credit line to borrow funds using its Bitcoin holdings as collateral. According to the board resolution, the facility will provide liquidity for future BTC acquisitions while supporting the company’s broader capital allocation strategy.

The initiative reflects a shift toward using Bitcoin as a strategic balance sheet asset rather than a speculative holding. By using BTC as collateral, Metaplanet aims to increase asset yield while reducing equity dilution. Company representative Simon Gerovich noted the facility enables “flexible execution as part of the company’s capital allocation strategy.”

Stock Performance and Market Reaction

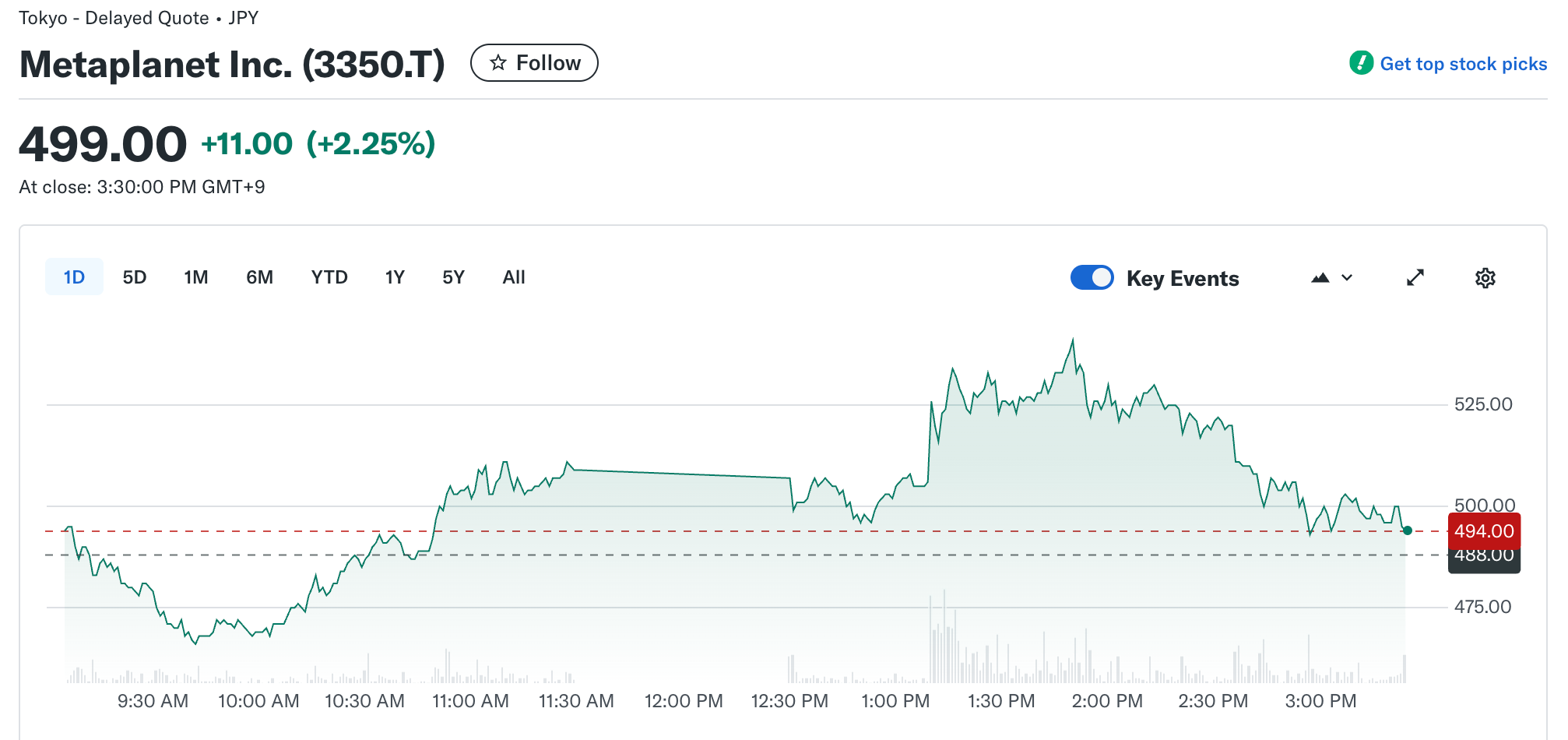

Following the announcement, Metaplanet shares closed at JPY 499 on October 28, up 2.25% from the previous session. The market response indicates investor interest in the company’s dual approach of BTC-backed financing and share buybacks.

Despite the uptick, some investors remain cautious due to high valuation multiples and potential volatility in Bitcoin prices. If BTC values decline, the collateral’s effectiveness could be reduced, potentially affecting loan terms and liquidity requirements.

Critical Perspectives and Risk Considerations

Some market commentators have raised concerns regarding Metaplanet’s strategy.

A crypto analyst stated that selling BTC to fund share buybacks would be “straight dumb, pure death spiral,” but using BTC as collateral for buybacks is “an interesting move” that limits downside risk.

They further noted that the key risks involve collateral ratios and interest rates during a BTC downtrend. Additionally, they highlighted that maintaining share price premiums depends on the company’s ability to manage liquidity and investor demand, suggesting careful monitoring is required to avoid unintended financial stress.

The post Metaplanet Secures $500M Bitcoin-Backed Credit Line, Expands Treasury Strategy appeared first on BeInCrypto.

24h Most Popular

24h Most Popular

Utilities

Utilities