Peter Brandt, a veteran trader with decades of market experience, has taken a short position in Bitcoin futures.

Despite being a long-term holder of BTC ($109,808.00), Brandt is trading against it in the short term based on technical signals that suggest further downside is possible.

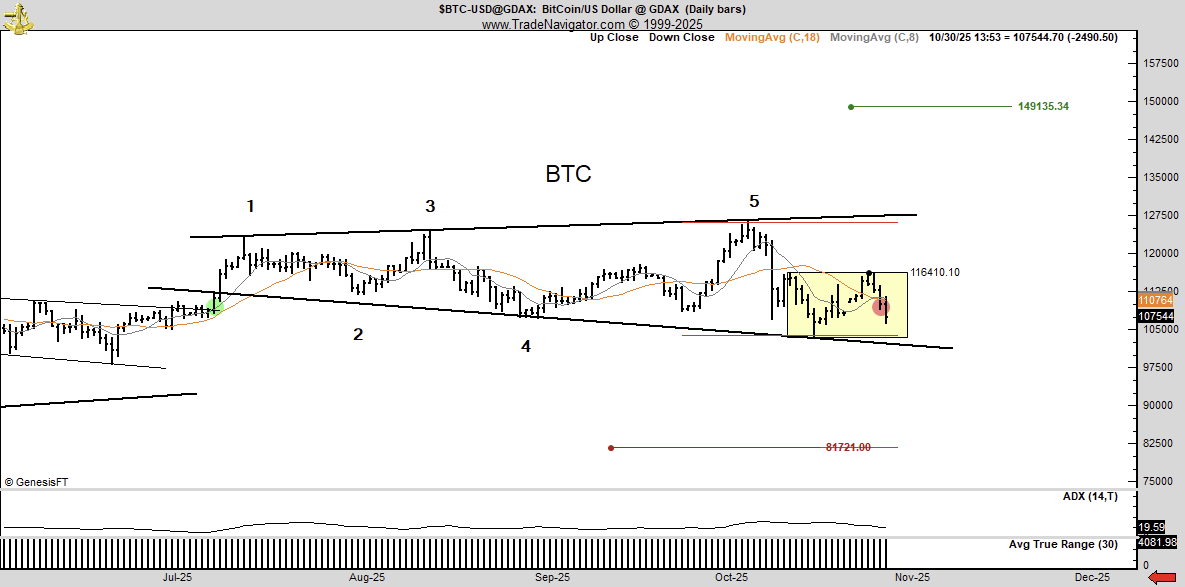

Broadening Pattern Indicates Risk

On the daily chart, Brandt identified a broadening formation, sometimes referred to as a megaphone pattern. It shows five distinct swings, with the most recent top near $126,000. After this high, Bitcoin moved into a sideways range between $106,000 and $116,000 before dipping below the south boundary.

Source: Peter Brandt/X

Source: Peter Brandt/XCurrently, the price sits near $109,500, following a 2% drop in the past day and 2% over the last week. This breakdown below the range supports Brandt’s short-term bearish setup. If the move continues, potential price levels to watch include $97,000 and $84,721.

Order Book Shows Liquidity Above Price

Market data from Coinglass shows that most of the order book liquidity sits above the current price. The $113,000 to $116,000 range contains large clusters of limit orders and stop-losses. Rekt Fencer posted,

All $BTC liquidity is sitting above the current price.

Just one pump and shorts get wiped.

Is the V-reversal loading right now? pic.twitter.com/57OzobYCei

— Rekt Fencer (@rektfencer) October 31, 2025

A sudden move higher could trigger short liquidations, leading to a quick price bounce. Below current levels, there are fewer large orders, which may weaken support on the way down.

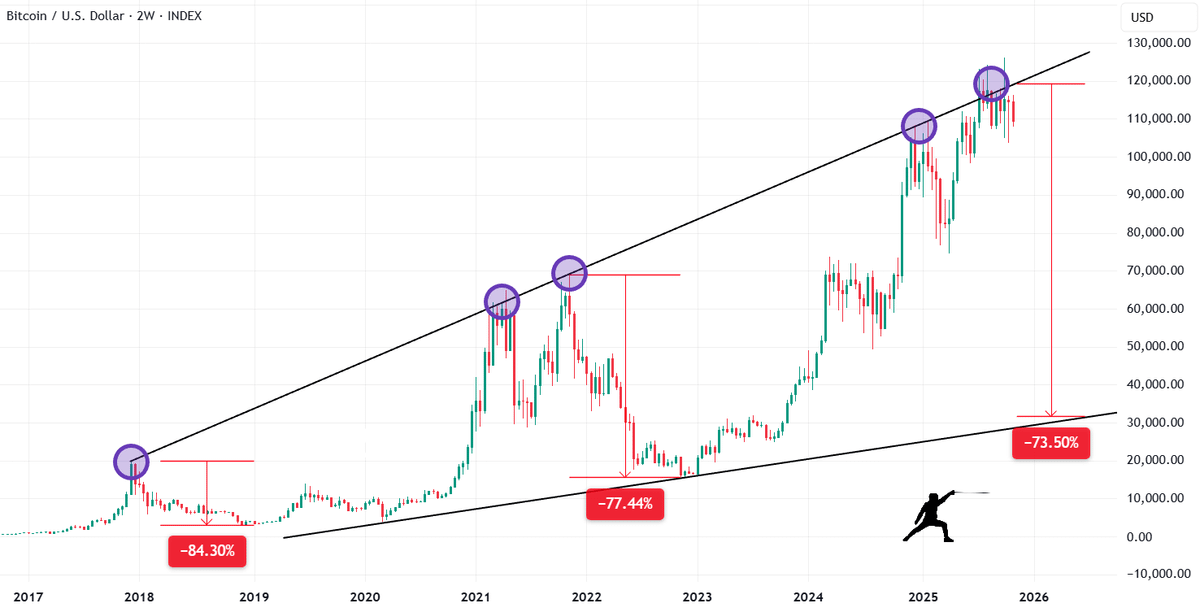

Notably, Bitcoin has a history of large drawdowns after hitting the upper boundary of its long-term trend channel. Past rejections have led to drops of 84% and 77%. The latest chart shows another rejection near this same trendline, with a potential 73% decline if the pattern holds.

Rekt Fencer added,

“Every time Bitcoin rejects this line, it dumps 70%… Hope you are ready for $BTC at $40,000.”

A move toward that zone would match the lower boundary of the multi-year channel.

Source: Rekt Fencer/X

Source: Rekt Fencer/XRate Cut Sparks Market Reaction

The Federal Reserve’s recent 0.25% rate cut led to volatility across markets. Bitcoin briefly fell below $108,000 after Fed Chair Jerome Powell’s comments, as traders reacted to the policy shift. Some described it as a classic “buy the rumor, sell the news” event.

Meanwhile, on-chain data shows falling BTC balances on exchanges, suggesting reduced supply. As CryptoPotato reported, large transactions above $1 million have also reached a two-month high, which points to continued interest from large holders. However, the asset remains under pressure as short-term uncertainty persists.

The post Why Peter Brandt Expects Bitcoin (BTC) to Fall appeared first on CryptoPotato.

.png)

24h Most Popular

24h Most Popular

Utilities

Utilities